Ripple (XRP) Pilots and Partnerships: A Global Overview

Ripple (XRP) has been making waves in the world of cross-border payments, forging partnerships and running pilots with banks, fintechs, and payment providers across the globe. If you’re curious about where Ripple’s technology is being tested or adopted, this post is your one-stop guide—complete with country-by-country highlights and maps for context.

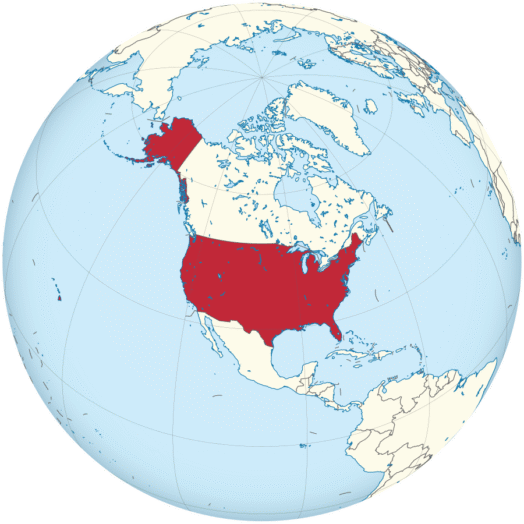

United States

Partnerships:

Ripple’s U.S. presence is massive, with collaborations including American Express, Bank of America, Citi, Wells Fargo, PayPal, MoneyGram, Western Union, The Clearing House (FedWire), DTCC, CLS Group, Voyager Digital, Equens (Sia group), BNY Mellon, and Amazon Pay. These partnerships focus on instant, low-cost international transactions and blockchain-based payment rails.

Pilots:

Notable pilots include Bank of America’s 2018 xRapid trial for real-time payments to Mexico, the FedNow 2022 real-time settlement pilot (with Bank of America and Wells Fargo), and the World Bank’s 2020 “Remittances through Blockchain” project.

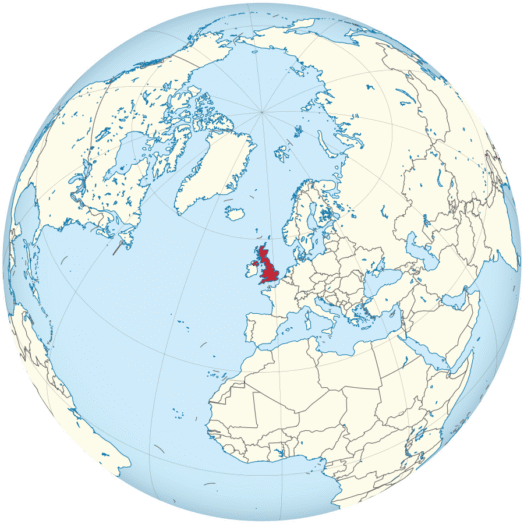

United Kingdom

Partnerships:

Ripple’s UK partners include Azimo, Santander (One Pay FX, cross-border with Spain), and MoneyGram.

Pilots:

Santander’s One Pay FX (2018) was a landmark UK-Spain corridor pilot. Other notable pilots include Banca Monte Dei Paschi di Siena (Italy-UK corridor) and Alpha Bank Greece (Greece-UK corridor).

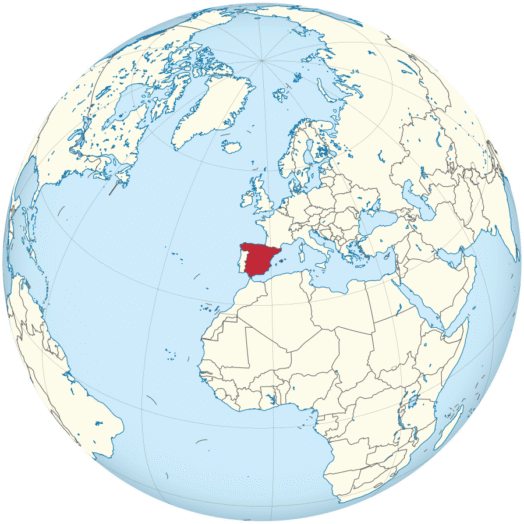

Spain

Partnerships:

Santander (One Pay FX) and BBVA are Ripple’s key Spanish partners.

Pilots:

Santander’s UK-Spain pilot and BBVA’s 2019 proof-of-concept for international transactions stand out.

Banco Santander has launched One Pay FX, a blockchain-based remittance service that uses XRP for cross-border payments. It was for testing the of use XRP for cross-border payments between the UK and Spain.

Switzerland

Partnerships:

UBS and SEBA Bank have both explored Ripple’s tech.

SEBA is a digital asset banking platform that has integrated xRapid for cross-border payments.

Pilots:

UBS ran a cross-border payments trial.

UBS has completed the trial using XRP for cross-border payments and is considering implementing the technology.

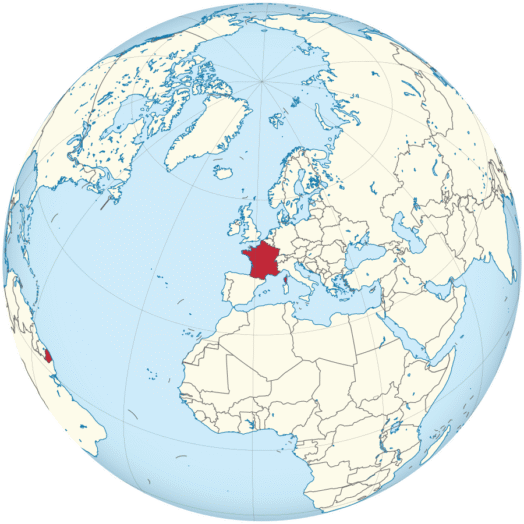

France

Partnerships:

Societe Generale is a major French partner.

Pilots:

Societe Generale’s 2020 proof-of-concept for international transactions. It is one of the largest banks in Europe, which has tested Ripple’s ODL service for international transactions.

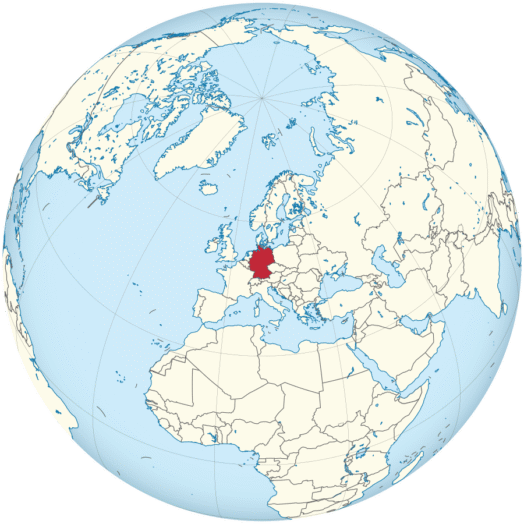

Germany

Partnerships:

Commerzbank and Fidor Bank have both tested Ripple’s solutions.

Pilots:

Commerzbank’s 2020 cross-border payments pilot.

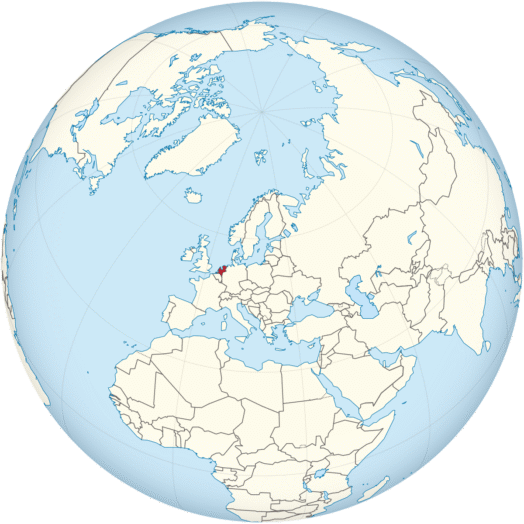

Netherlands

Partnerships:

ING and ABN AMRO have both piloted Ripple’s xRapid platform.

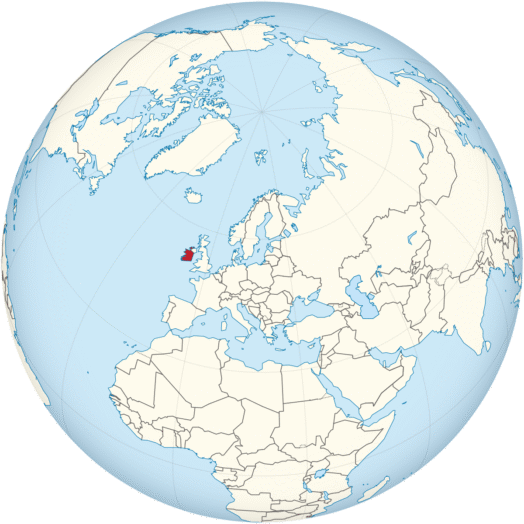

Ireland

Partnerships:

Interbank completed a pilot for cross-border payments.

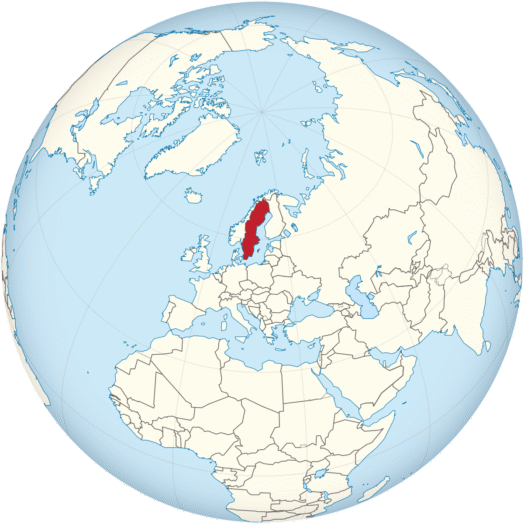

Sweden

Partnerships:

Svenska Handelsbanken ran a trial for cross-border payments.

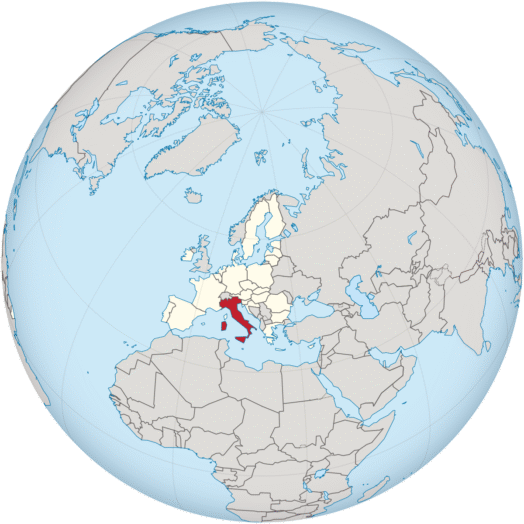

Italy

Partnerships:

UniCredit and Banca Monte Dei Paschi di Siena have both tested Ripple’s tech. Banca Monte Dei Paschi di Siena has partnered with Ripple to test its On-Demand Liquidity (ODL) service.

In 2020, the bank announced a pilot program to use XRP for cross-border payments between Italy and the UK.

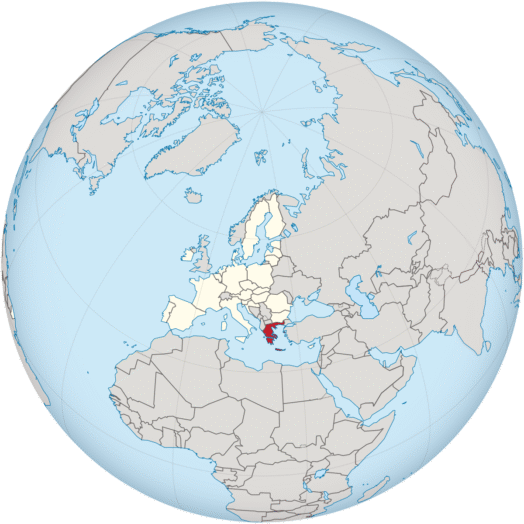

Greece

Partnerships:

Alpha Bank piloted Ripple’s On-Demand Liquidity (ODL) service. The bank used XRP to facilitate fast and low-cost international transactions with its partner banks in other countries.

Austria

Partnerships:

Buchwald, an Austrian payment processor, is a Ripple partner.

Japan

Partnerships:

SBI Remit, MUFG, and SBI Holdings are Ripple’s key Japanese partners.

Pilots:

SBI Remit and MUFG both ran cross-border payment pilots in 2020.

Singapore

Partnerships:

OCBC and Singapore Exchange (SGX) have both explored Ripple’s blockchain for payments.

In 2020, OCBC completed a proof-of-concept pilot using Ripple’s xRapid service to facilitate real-time international transactions.

In 2020, SGX announced a partnership with Ripple to explore the use of blockchain technology for cross-border payments. The two organizations will work together to test the use of XRP as a bridge currency for instant and low-cost international transactions.

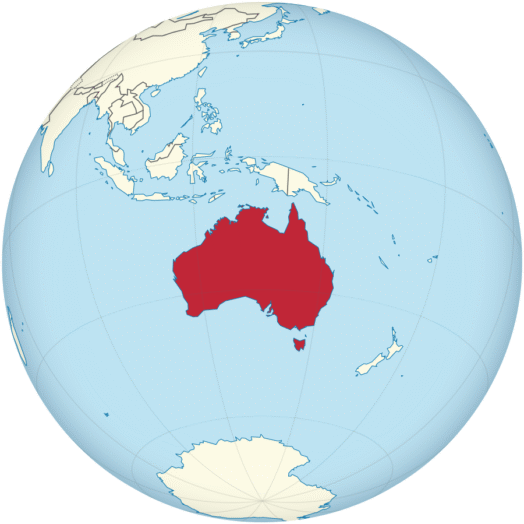

Australia

Partnerships:

Commonwealth Bank of Australia (CBA), ANZ, and the Australian Securities and Investments Commission (ASIC) have all piloted Ripple’s solutions.

In 2018, CBA completed a proof-of-concept pilot using Ripple’s xRapid service to facilitate real-time international payments.

In 2020, ANZ completed a proof-of-concept pilot using Ripple’s xRapid service to facilitate real-time international transactions.

In 2020, ASIC announced a collaboration with Ripple to explore the use of blockchain technology for cross-border payments. The two organizations will work together to test the use of XRP as a bridge currency for instant and low-cost international transactions.

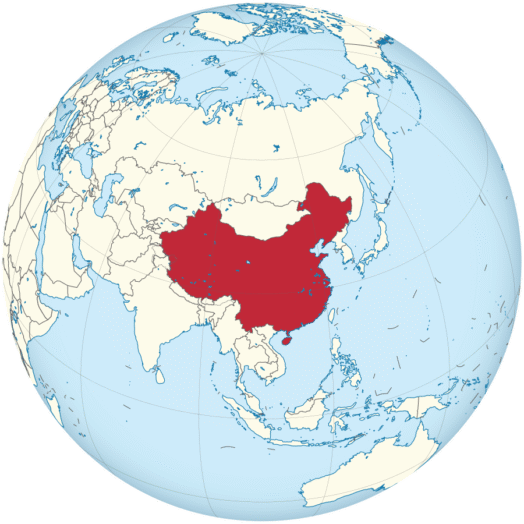

China

Partnerships:

China Construction Bank (CCB), Bank of China (BOC), and UnionPay have all partnered with Ripple.

In 2022, CCB announced a partnership with Ripple to use its xRapid service for cross-border payments.

In 2022, UnionPay announced a partnership with Ripple to use its xRapid service for cross-border payments and digital asset settlement.

In 2022, BOC announced a collaboration with Ripple to explore the use of blockchain technology for cross-border payments.

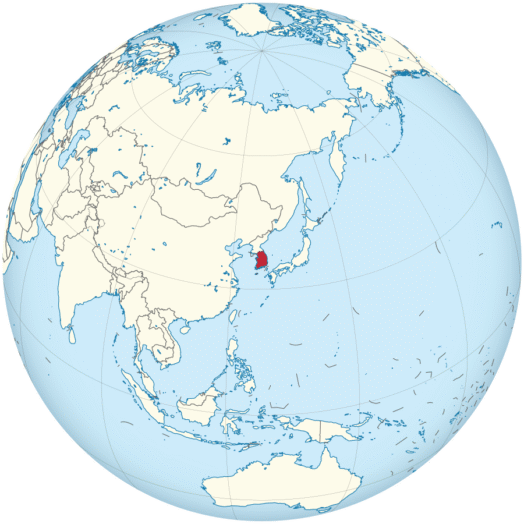

South Korea

Partnerships:

KEB Hana Bank and KB Kookmin Bank have both piloted Ripple’s tech.

In 2020, KEB Hana Bank completed a proof-of-concept pilot using Ripple’s xRapid service to facilitate real-time international transactions.

In 2022, KB Kookmin Bank announced a partnership with Ripple to use its xRapid service for cross-border payments.

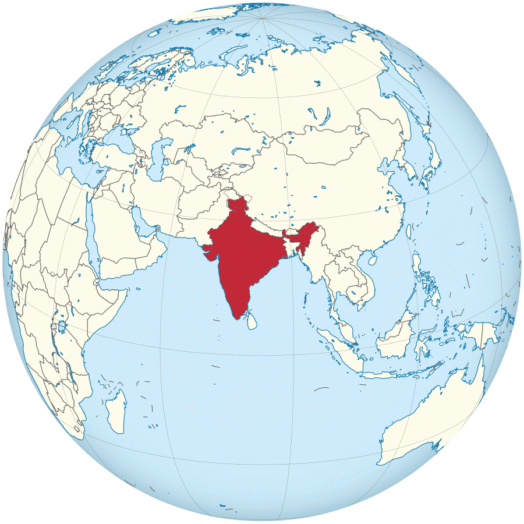

India

Partnerships:

HDFC Bank ran a pilot for cross-border payments.

In 2020, HDFC Bank launched a pilot program with Ripple to use XRP for cross-border payments and liquidity provision.

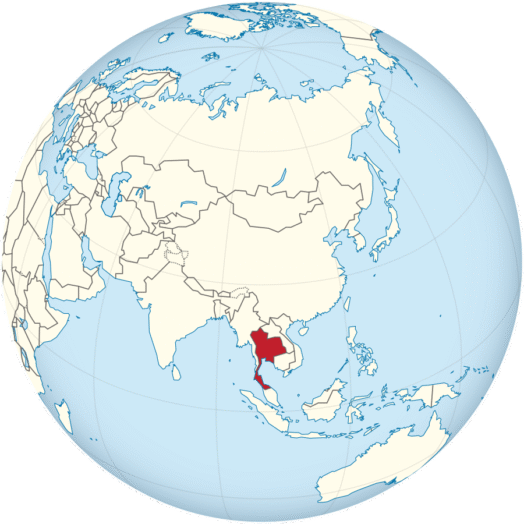

Thailand

Partnerships:

Bank of Thailand and Kasikornbank have both piloted Ripple’s solutions.

In 2019, Kasikornbank launched a pilot program with Ripple to use XRP for cross-border payments and liquidity provision.

In 2020, the Bank of Thailand completed a proof-of-concept pilot using Ripple’s xRapid service to facilitate real-time international transactions.

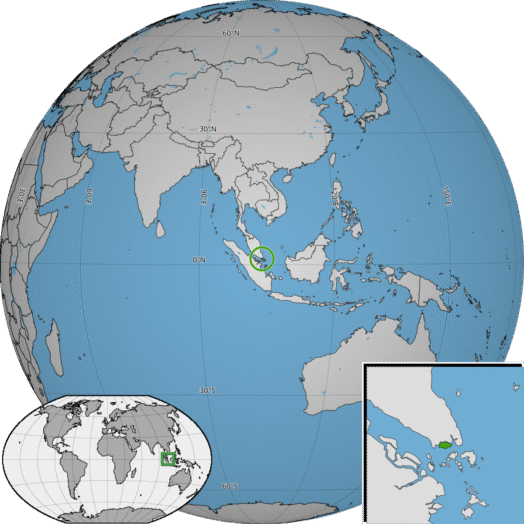

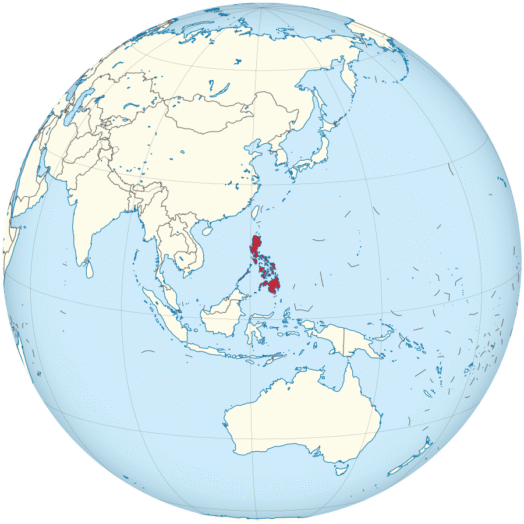

Philippines

Partnerships:

RCBC ran a pilot for cross-border payments.

In 2019, RCBC launched a pilot program with Ripple to use XRP for cross-border payments and liquidity provision.

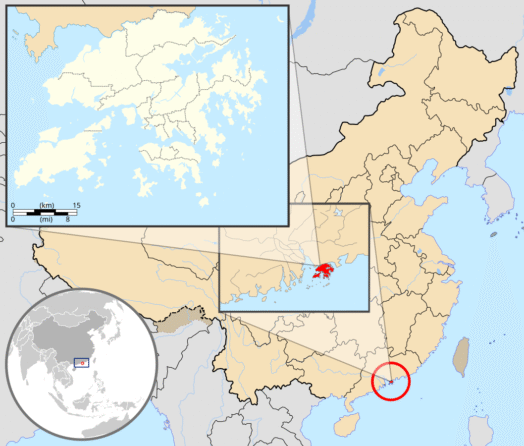

Hong Kong

Partnerships:

Hong Kong Monetary Authority (HKMA) explored blockchain for cross-border payments.

In 2019, HKMA announced a collaboration with Ripple to explore the use of blockchain technology for cross-border payments. The two organizations will work together to test the use of XRP as a bridge currency for instant and low-cost international transactions.

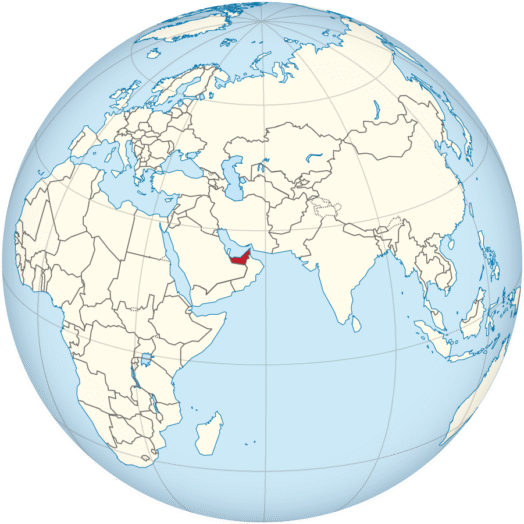

UAE / Midde East

Partnerships:

UAE Exchange (Finablr) and Mashreq (Dubai) have both piloted Ripple’s tech.

In 2018, Mashreq completed a proof-of-concept pilot using Ripple’s xRapid service to facilitate real-time international payments.

In 2019, UAE Exchange completed a pilot program using Ripple’s xRapid service to facilitate real-time international transactions.

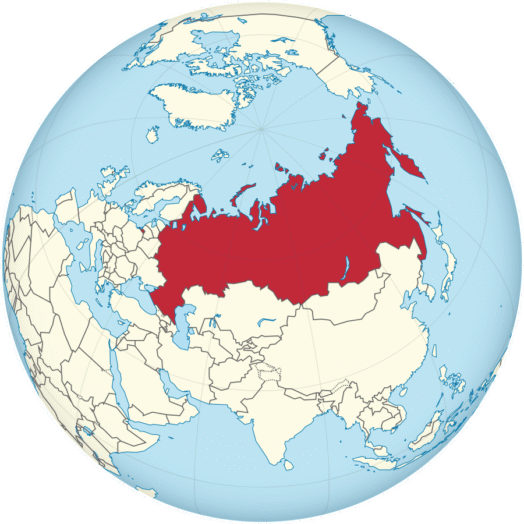

Russia

Partnerships:

Sberbank, TCS Group Holding, Promsvyazbank, National Settlement Depository (NSD), Sberbank CIB, and Rostelecom have all tested Ripple’s solutions.

- Sberbank: In 2018, Sberbank, Russia’s largest bank, partnered with Ripple to test the use of XRP for cross-border payments.

- TCS Group Holding: TCS Group Holding, a Russian financial holding company, has tested the use of Ripple’s xRapid service for instant and low-cost international transactions.

- Promsvyazbank: Promsvyazbank, a Russian bank, has also partnered with Ripple to test the use of XRP for cross-border payments.

- National Settlement Depository (NSD): NSD, Russia’s central securities depository, has tested the use of Ripple’s technology for settlement and custody of digital assets.

Ukraine

Partnerships:

Monobank offers instant international transactions using Ripple.

Kazakhstan

Partnerships:

Kaspi Bank piloted Ripple’s cross-border payments.

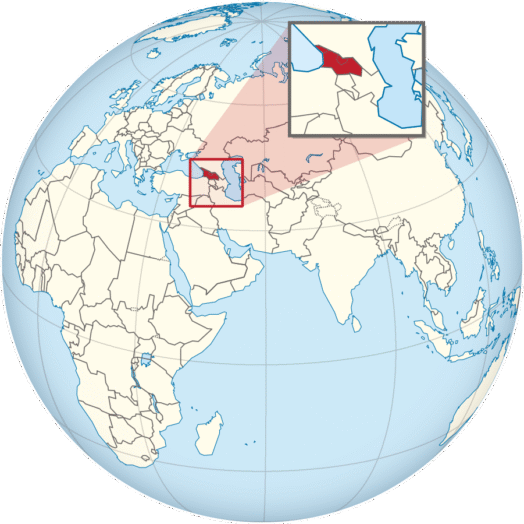

Georgia

Partnerships:

TBC Bank tested Ripple’s cross-border payments.

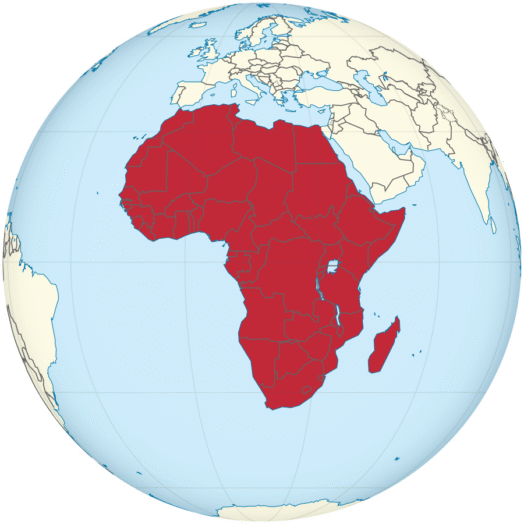

Africa (General)

Partnerships:

Ecobank (pan-African), Kenya’s Sambora, Ghana’s Sendy, South Africa’s Standard Bank and South African Reserve Bank, and Nigeria’s Flutterwave have all piloted Ripple’s solutions for cross-border payments and remittances.

- Kenya: In 2018, Ripple partnered with Sambora, a Kenyan fintech company, to test the use of XRP for cross-border payments between Kenya and Uganda.

- Ghana: In 2020, Ripple partnered with Sendy, a Ghanaian logistics and delivery service, to test the use of XRP for cross-border payments between Ghana and other African countries.

- South Africa: In 2019, Ripple partnered with Standard Bank, one of South Africa’s largest banks, to test the use of XRP for cross-border payments between South Africa and other countries.

- Nigeria: In 2020, Ripple partnered with Flutterwave, a Nigerian fintech company, to test the use of XRP for cross-border payments between Nigeria and other African countries.

Mexico

Partnerships:

Cuallix and Bank of Mexico have both piloted Ripple’s cross-border payment solutions.

In 2018, BofA completed a pilot program using Ripple’s xRapid service, which enabled the bank to send real-time international payments in Mexico.

In 2019, the Bank of Mexico partnered with Ripple to test the use of XRP for cross-border payments. The pilot aimed to reduce transaction times and costs.

In 2020, Ripple launched a pilot program with Cuallix, a Mexican remittance provider, to test the use of XRP for fast and low-cost international transactions.

Brazil

Partnerships:

Banco Real (Bradesco), Bradesco, Itaú Unibanco, Banco Santander Brazil, Mercado Pago, and Centro Financiero Internacional (CFI) have all worked with Ripple.

The largest private bank in Brazil, Bradesco, has been testing XRP for cross-border payments since 2018. The bank aims to use XRP to increase efficiency and reduce costs.

In 2019, Ripple partnered with Banco Real (a subsidiary of the Brazilian bank Bradesco) to launch a blockchain-based payment system for cross-border transactions.

In 2020, Banco Santander Brazil launched a pilot program using XRP for cross-border payments with the US-based bank, Bank of America.

The popular e-commerce platform in Argentina and Brazil, Mercado Pago, has partnered with Ripple to test the use of XRP for cross-border payments.

Itaú Unibanco, has also tested XRP for cross-border payments. The pilot aimed to improve transaction speed and security.

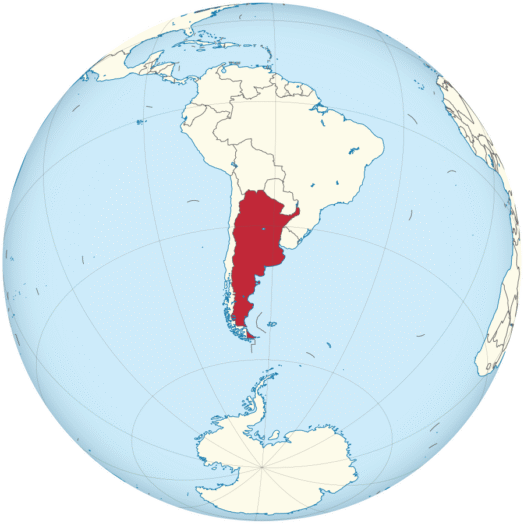

Argentina

Partnerships:

Banco Galicia, Mercado Pago, and the Argentine government have all piloted Ripple’s technology.

The Argentine government has launched a pilot program to test the use of XRP for cross-border payments with its neighbors.

Banco Galicia, a major bank in Argentina, has completed a pilot program using Ripple’s technology to facilitate fast and low-cost international transactions.

The popular e-commerce platform in Argentina and Brazil, Mercado Pago, has partnered with Ripple to test the use of XRP for cross-border payments.

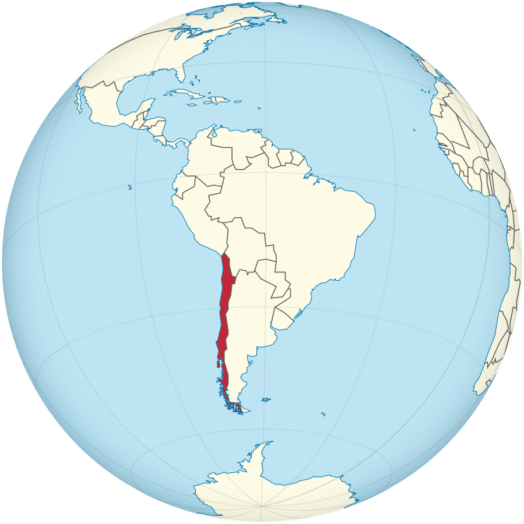

Chile

Partnerships:

Banco Santander Chile and other Chilean banks have piloted Ripple’s cross-border payments.

Peru

Partnerships:

Banco de Credito del Peru (BCP) piloted Ripple’s blockchain-based payments.

In 2019, Ripple partnered with the Peruvian bank Banco de Credito del Peru (BCP) to launch a blockchain-based payment system for cross-border transactions.

Colombia

Partnerships:

Davivienda and Cámara de Comercio e Industria (CCI) have both piloted Ripple’s solutions.

In 2020, Ripple launched a pilot program with the Colombian bank Davivienda to test the use of XRP for cross-border payments.

Cámara de Comercio e Industria (CCI): A business association in Colombia that aims to promote trade and commerce in the region.

Other/Global Initiatives

Partnerships:

Ripple’s global reach includes R3, IBM, SWIFT Innovation Hub, and Project Mariana (BIS, with Bangladesh, South Africa, Brazil).

Project Mariana!

Project Mariana is a research collaboration between Ripple and the Bank for International Settlements (BIS). The project aims to explore the potential of blockchain technology in facilitating cross-border payments.

In 2020, the BIS published a report titled “Global Foreign Exchange Market: Turning Point?” which highlighted the need for more efficient and inclusive foreign exchange markets. In response, Ripple proposed an experiment using its xRapid service to facilitate cross-border payments between banks in different countries.

Project Mariana is designed to test the feasibility of using blockchain technology to settle cross-border payments in real-time, reducing the settlement time from days or weeks to mere seconds.

The project involves several central banks and financial institutions worldwide, including:

- Bangladesh’s Central Bank: The Bangladesh Central Bank has been working with Ripple on the project.

- South Africa’s Reserve Bank: The South African Reserve Bank is participating in the experiment.

- Brazil’s Banco Santander: Banco Santander (São Paulo) is collaborating with Ripple to test the use of xRapid for cross-border payments.

The goal of Project Mariana is to explore how blockchain technology can improve the efficiency, speed, and transparency of cross-border payment systems, ultimately reducing costs and increasing financial inclusion.

Final Thoughts

Ripple’s global network of pilots and partnerships is a testament to the growing demand for faster, cheaper, and more transparent cross-border payments. From the Americas to Europe, Asia, Africa, and beyond, Ripple’s technology is being tested and adopted by some of the world’s largest banks and payment providers.

Did we miss a country or want to dive deeper into a specific partnership? Drop your questions below!

Note: All maps are for visual context and sourced from Wikimedia Commons. For the latest on Ripple’s partnerships, always check official Ripple announcements and news sources.

XRP

XRP  Stellar

Stellar  Hedera

Hedera  Algorand

Algorand  VeChain

VeChain  Arbitrum

Arbitrum  Sei

Sei  JasmyCoin

JasmyCoin  Telcoin

Telcoin  Zebec Network

Zebec Network  Wormhole

Wormhole  XPR Network

XPR Network  Velo

Velo  Constellation

Constellation  SWFTCOIN

SWFTCOIN  Stronghold

Stronghold  Propy

Propy  Celer Network

Celer Network  ELYSIA

ELYSIA  MESSIER

MESSIER  Parcl

Parcl